15+ fha loan violations

Guaranteed Rae to pay 15m over alleged FHA VA loan violations. The FHA appraisal is a tool for your lender to establish the fair market value of the property and to establish the adjusted value of the home for purposes of setting the loan amount.

Homebuying Mistakes

The recent sanctions issued against those 120 lenders include a wide range of punishments--from fines in some cases to revoking FHA approval where appropriate.

. The FHA and the Government Crackdown on Loan Fraud. In they eyes of some such figures indicate buying a new. Has agreed to pay the United States 1506 million to resolve allegations that it violated the False Claims Act and the Financial Institutions Reform Recovery.

At Lubliner Law our expert attorneys offer both condo association training and homeowners association training. An affiliated business arrangement is defined in section 3 7 of RESPA 12 USC. Thats what happened in the.

3 Fair Lending Violation Examples. B Violation and exemption. FHA Appraisal Rules.

Change Date December 23 2010 41552. April 29 2020 548 pm By Ben Lane. The appraisal is not a complete in-depth top-to-bottom inspection of the property and should never be used by the borrower as.

The FHA official site reports charges against a La Crosse Wisconsin landlord for violating the Fair Housing act for refusing to rent an apartment to an African American couple. The FHA policy on objections to title for customary easements restrictions and encroachments and correcting property address discrepancies. These trainings can help prevent FHA violations.

More than 15 million to resolve allegations that it violated the False Claims Act and the Financial. The following information and collateral materials are provided to help FHA lenders. Guaranteed Rate Inc.

An affiliated business arrangement. It is simple to book a training for your. Financial Freedom a reverse mortgage servicer resolved claims that it improperly requested payments from an FHA insured reverse mortgage program.

Financial Freedom paid 89 million. Federally regulated fair lending is a closely-coordinated combination of requirements and prohibitions in several consumer protection and. The Real Estate Settlement Procedures Act RESPA is the federal statute that governs the mortgage servicing industry and protects your rights under the CARES Act.

Treasury Secretary Timothy Geithner announced a crackdown on fraudulent lending practices the result was more than 2000 open mortgage fraud cases. Limited Denial of Participation. Return to FHA Lenders.

In these trainings your team will learn the basics of FHA regulations including protocols and requirements mandates and updates to the law. Guaranteed Rate will pay 1506 million to settle allegations that it violated Federal Housing Administration and Department of Veterans Affairs lending. Model Appraisal Exterior-Only Certification 320 Valid for appraisals with effective dates through June 30 2021 See ML 2021-06 and FHA Info 21-44 Model Appraisal Desktop-Only.

Guaranteed Rate has agreed to pay more than 15 million to resolve allegations that it violated the False. Thats a 400 increase from pre-housing crisis figures from 2004. Guaranteed Rae to pay 15m over alleged FHA VA loan violations.

Protecting the federal taxpayers from those who submit false or fraudulent claims on the federal fisc is a crucial function of the Department of Justice and that function includes.

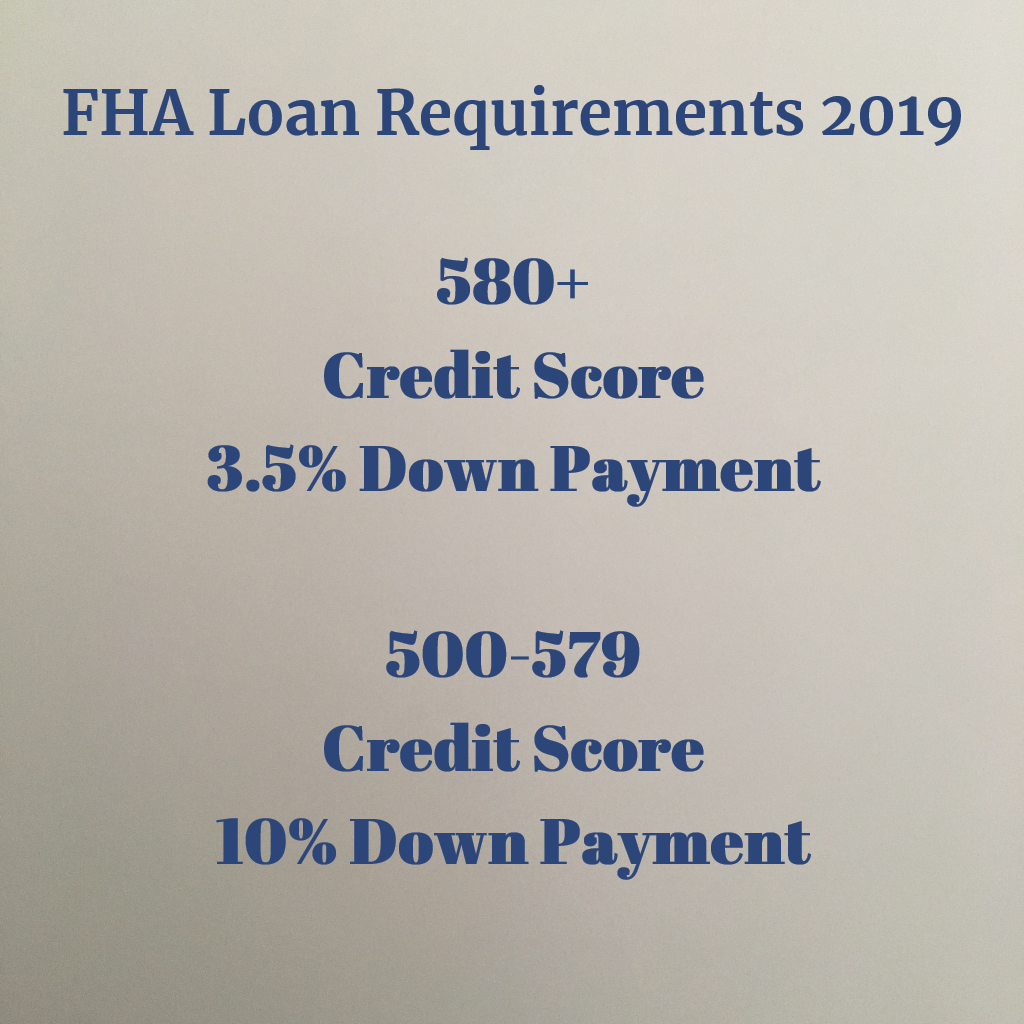

Fha Credit Requirements For 2022 Fha Lenders

What Is The Minimum Credit Score Needed For An Fha Loan Credit Sesame

Verifying Borrower Identity National Association Of Mortgage Underwriters Namu

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

Over 15 Offers And Still Rejected The Truth About Fha Loans Youtube

Mortgage Resume Samples Velvet Jobs

New Fha Guidelines 2019 Fha Loan Guidelines Credit Score And More

Fair Lending And The Home Mortgage Disclosure Act Compliance Ai

Verifying Borrower Identity National Association Of Mortgage Underwriters Namu

/GettyImages-1179800155-59b16e6912cc4bc7a386f4f0a5ab861f.jpg)

Do Fha Loans Have Prepayment Penalties

New Fha Rules Could Make It Tougher To Get A Loan Easier To Buy A Condo

Mortgage Resume Samples Velvet Jobs

Fha Loans Are Bad Youtube

Steps Toward Homeownership

Fecmj1aaegs2mm

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

Processing Manager Resume Samples Velvet Jobs